Chilean voters rejected an attempt to replace the country’s dictatorship-era constitution Sunday, the second failure in as many years.

Sunday’s vote was drafted by a conservative-led constitutional convention and contained measures authorizing immediate deportation of undocumented migrants, as well as enshrining limitations on the state’s role in education and public health; the referendum failed with 56% of voters against (44% in favor), with 84% turnout. The vote in September 2022 failed by an even wider margin, and was drafted by a convention with a majority of left-leaning delegates.

The failure to pass constitutional reform, which was a central demand of the estallido social protest movement of 2019, marks another notable policy setback for incumbent President Gabriel Boric. Boric is a 37-year-old social democrat with two years left of his mandate; he is ineligible to run for a second term in the next presidential election in December 2025 (presidential reelection is prohibited under Chilean law).

Since defeating right-wing rival José Antonio Kast in the 2021 election by a 10-point margin, President Boric has thus far been unable to implement a number of campaign pledges, including expanding Chile’s welfare net and ending the country’s private pension system.

Also notably missing from President Boric’s list of legislative accomplishments: finalizing a strategy to reorganize the country’s lithium industry.

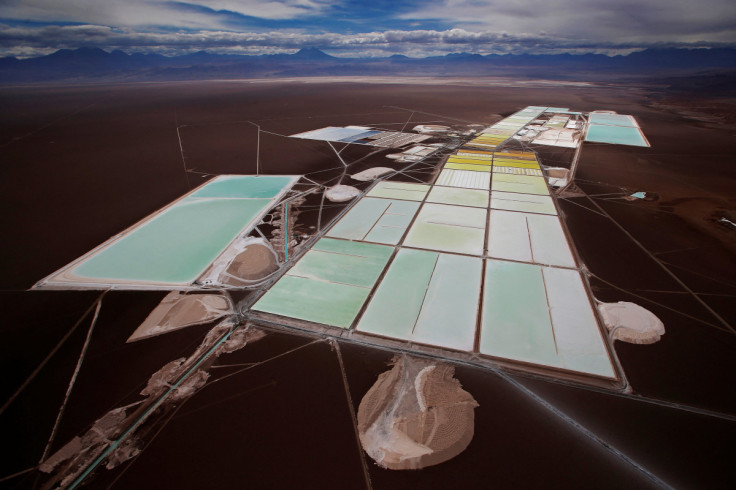

In April, Boric first announced his government’s plans to present a “national lithium strategy” bill to Congress that would create a state-run lithium mining corporation, as well as oblige Chile’s existing private lithium miners to renegotiate their production contracts with terms more favorable to the Chilean state.

Lithium is a major export product and source of foreign capital for the Chilean economy; Boric’s planned industry reorganization stands to greatly alter the country’s macroeconomic trajectory in the coming decades as global lithium demand continues to rise.

But as of the end of 2023, the exact details of Boric’s national lithium strategy remain unclear. No legislation has yet been submitted to Congress for debate, and preliminary negotiations between private lithium miners and state representatives have yet to conclude.

The uncertainty of Chile’s lithium reorganization hangs over Chile’s most profitable industry at a critical period, as global investors looking to capitalize on the coming lithium boom find themselves with an increasing number of profitable options elsewhere—including Argentina, Australia, the U.S., Brazil and China.

Chile’s Lithium Sector Hits Pause

Reuters

In 2022, Chile was the world’s second-largest producer of battery-grade lithium, the demand for which is projected to skyrocket in coming years as electric vehicles continue to proliferate global markets.

SQM entered negotiations in May with Codelco, the state copper mining company, to alter its lithium extraction contract which is currently set to expire in 2030. These negotiations are reportedly nearing completion, as Codelco’s president Máximo Pacheco confirmed last Thursday, but the terms of SQM’s new contract still remain unclear.

Chilean congressional deputies have discussed the prospect of Boric’s lithium plan, but Congress has yet to vote on any legislation that would authorize any tangible changes to tax structures or environmental regulations for the lithium sector, nor has any control of the lithium sector been formally handed to Codelco.

With two years remaining in President Boric’s term, experts are skeptical that the lithium reorganization plan will take shape to the extent desired by the administration.

“I don’t think the government really believes the [state-owned] company will be approved,” Juan Carlos Jobet, who was Minister of Energy and Mining under Boric’s predecessor Sebastián Piñera, told S&P Global in September. “They sent the project to Congress just to comply with a commitment made during their campaign.”

With negotiations between Chile’s lithium miners and the state ongoing and the nature of the future regulatory environment unclear, new investments in Chile’s previously dominant lithium industry have dried up with no new projects underway, compared to a staggering 49 total projects either operational or under construction across the Andes in Argentina.

“We had roughly 60% global market share around 2010. We now have below 30% and most experts predict that we’re going to be below 15% by the end of the decade,” Jobet said.

Chile was the world’s largest lithium producer until the mid-2010s—it now has around half the battery-grade lithium output of Australia, the world’s current leading producer.

Also forecasted to drive down Chile’s share of global lithium markets in coming years are the United States, which is now reportedly home to two substantial deposits in Northern Nevada and Southern California, as well as neighboring Argentina and Bolivia, who have each attracted billions of dollars in foreign investment in new lithium facilities in recent years (albeit through drastically different strategies).

Chile’s national lithium strategy may end up proving beneficial to the long-term profitability of the country’s existing lithium miners, as volatile lithium prices make operations viable even with heavy tax burdens.

But as long as political dysfunction and more pressing legislative priorities continue to hamper the Boric administration’s ability to pass meaningful reforms, the lithium organization plan will remain unclear or half-hearted, deterring new investments at a critical period of exponential growth in global lithium markets.

As output from new projects in Argentina and the United States begins to flood global markets in the late 2020s and drive down lithium prices, both the Chilean state and private sector stand to miss out on substantial revenue—unless a strategy for sustainable growth can be clearly articulated (and soon).